- HIGHLIGHTS OF THIS ISSUE

- Part I

- Part III

- Qualified Student Loan and Qualified Mortgage Bonds

- Part IV

- Correction to REG-101552-24, I.R.B. 2024-13

- Charitable Remainder Annuity Trust Listed Transaction

- Advance Notice of Third-Party Contacts

- Definition of Terms

- Numerical Finding List1

- Finding List of Current Actions on Previously Published Items1

- How to get the Internal Revenue Bulletin

Internal Revenue Bulletin: 2024-16

April 15, 2024

These synopses are intended only as aids to the reader in identifying the subject matter covered. They may not be relied upon as authoritative interpretations.

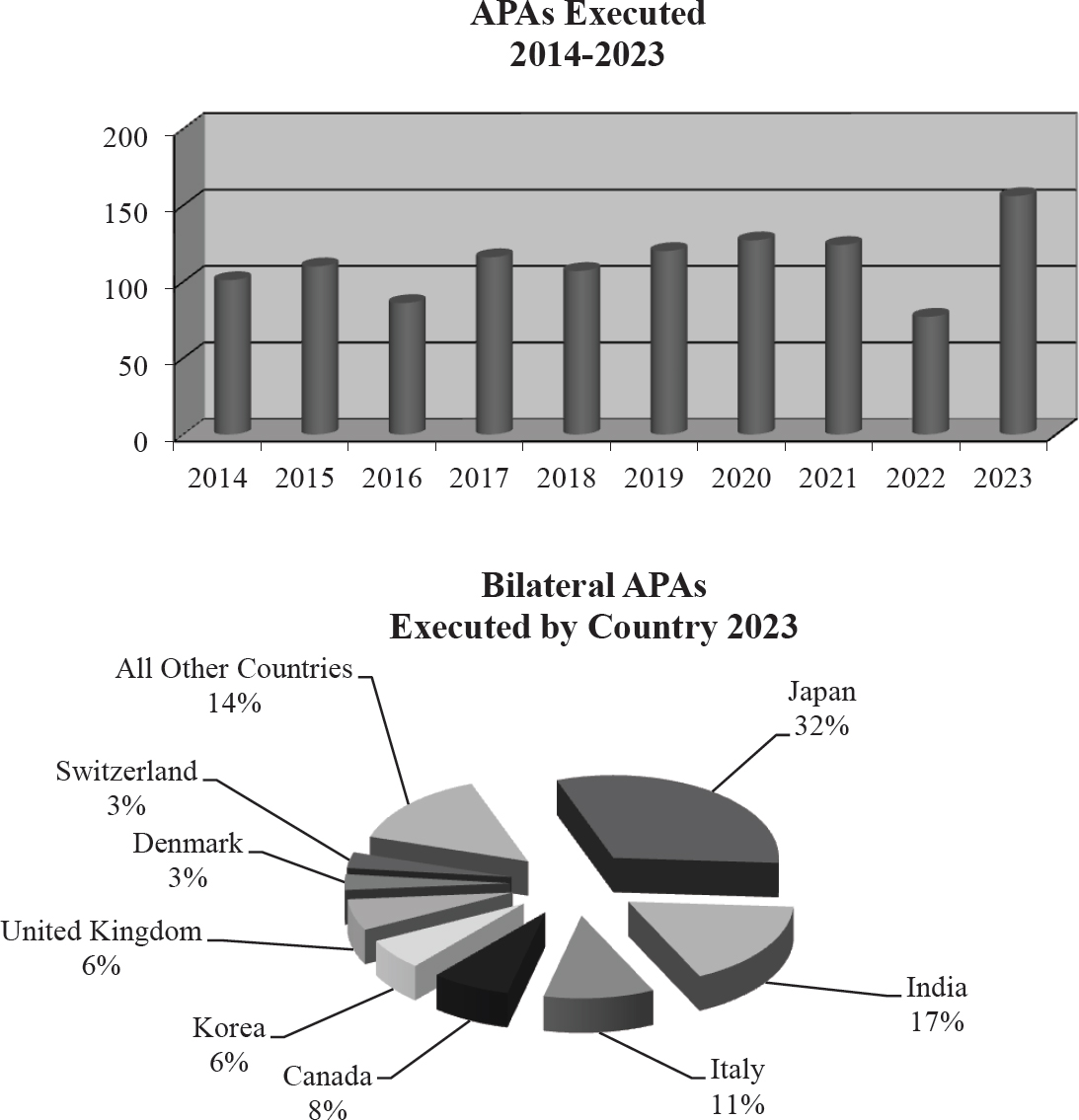

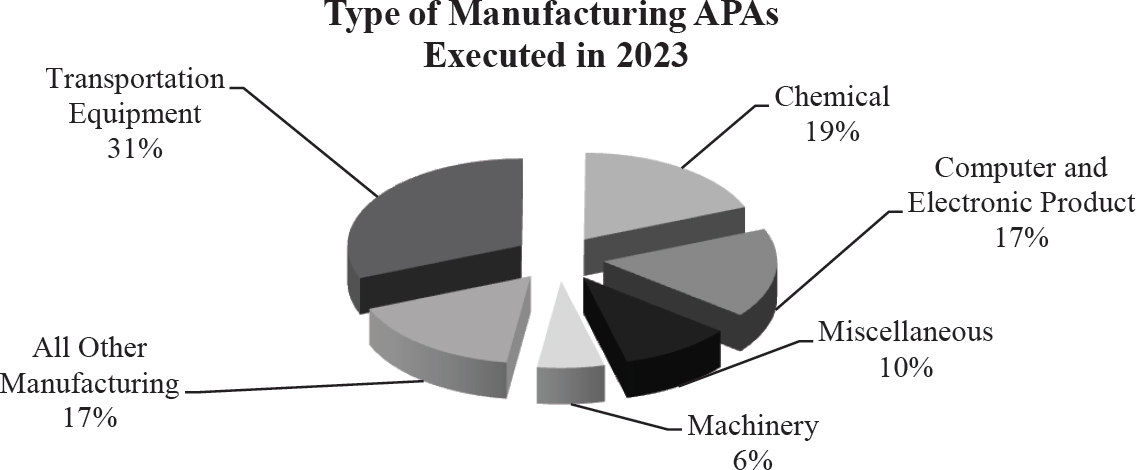

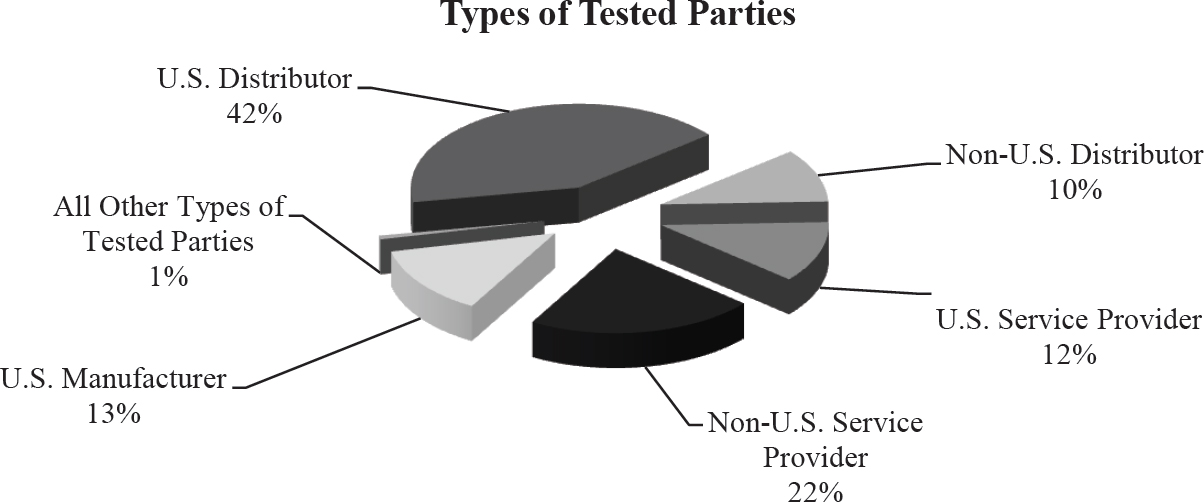

This Announcement is issued pursuant to § 521(b) of Pub. L. 106-170, the Ticket to Work and Work Incentives Improvement Act of 1999, which requires the Secretary of the Treasury to report annually to the public concerning advance pricing agreements (APAs) and the Advance Pricing and Mutual Agreement Program (APMA Program), formerly known as the Advance Pricing Agreement Program (APA Program). This twenty-fifth report describes the experience, structure, and activities of the APMA Program during calendar year 2023.

This Notice of Proposed Rulemaking revises the regulations pertaining to the advance notice to be provided to taxpayers prior to IRS contact with third parties to conform to the new statutory language of section 7602(c) enacted as part of the Taxpayer First Act of 2019 (TFA), Public Law 116-25 (133 Stat. 981). The proposed regulations also provide, pursuant to the Secretary’s authority in section 7602(c)(1)(B), exceptions to the 45-day advance notice requirement where delaying contact with third parties for 45 days after providing notice to the taxpayer would impair tax administration.

REG-101552-24, 2024-13 I.R.B. 741 (March 25, 2024) contains errors in the second sentence of the second column on page 743 and in the first sentence of the third column on page 746. These sentences incorrectly describe the requirement that members in an unincorporated organization reserve the right separately to take in kind or dispose of their pro rata shares of electricity produced, extracted or used, or any associated renewable energy credits or similar credits. This requirement was intended to be conjunctive, applying to both electricity and associated credits. The sentence on page 743 is corrected to read, “Second, the unincorporated organization’s members must enter into a joint operating agreement with respect to the applicable credit property in which the members reserve the right separately to take in kind or dispose of their pro rata shares of the electricity produced, extracted, or used, and any associated renewable energy credits or similar credits.” The sentence on page 746 is corrected to read, “(B) The members of which enter into a joint operating agreement in which the members reserve the right separately to take in kind or dispose of their pro rata shares of the electricity produced, extracted, or used, and any associated renewable energy credits or similar credits”.

This notice modifies Notice 2023-29, 2023-29 I.R.B. 1 (July 17, 2023), clarified by Notice 2023-45, 2023-29 I.R.B. 317 (July 17, 2023), by expanding the Nameplate Capacity Attribution Rule under section 4.02(1)(b) of Notice 2023-29 to include additional attribution property and by adding two 2017 North American Industry Classification System (NAICS) industry codes to the table in section 3.03(2) of Notice 2023-29 for purposes of determining the Fossil Fuel Employment rate (as defined in section 3.03(2) of Notice 2023-29).

This notice provides guidance for qualified student loan bonds to clarify certain requirements for tax-exempt bond financing for loan programs of general application approved by a State under § 144(b)(1)(B) (State Supplemental Loan programs). Specifically, this notice addresses eligibility of borrowers of loans through State Supplemental Loan programs and the loan size limitation for State Supplemental Loans. This notice also provides guidance on whether an issue of State or local bonds the proceeds of which are used to finance or refinance qualified student loans or to finance qualified mortgage loans is a refunding issue.

This Notice of Proposed Rulemaking (NPRM) would add a new regulation section promulgated under section 6011 of the Code to establish that Charitable Remainder Annuity Trust (CRAT) transactions described in the NPRM are listed transactions for purposes of Treasury Regulation § 1.6011-4 and sections 6111 and 6112. The transaction at issue is one in which taxpayers purport to eliminate recognition of ordinary income and/or capital gain on appreciated property contributed to a CRAT when the CRAT sells that property and purchases a single premium immediate annuity (SPIA). Taxpayers misapply the rules governing CRAT’s upon the sale of the appreciated property by the CRAT and also misapply the rules concerning the SPIA by treating the beneficiaries as the owners of the SPIA, rather than it being an asset of the CRAT funding the annuity payments from the trust.

The Department of the Treasury (Treasury Department) and the Internal Revenue Service (IRS) are issuing this revenue procedure to provide the process under § 48(e) of the Internal Revenue Code to apply for an allocation of environmental justice solar and wind capacity limitation (Capacity Limitation) as part of the low-income communities bonus credit program (Program) for the 2024 Program year. Additionally, this revenue procedure describes how the Capacity Limitation for the 2024 Program year will be divided across the facility categories described in §§ 48(e)(2)(A)(iii) and 1.48(e)-1(b)(2), the Category 1 sub-reservation described in § 1.48(e)-1(i)(1), and the additional selection criteria application options described in § 1.48(e)-1(h). Receipt of an allocation of Capacity Limitation increases the amount of an energy investment credit determined under § 48(a) for the taxable year in which certain solar and wind-powered electricity generation facilities are placed in service.

26 CFR 601.201: Rulings and determination letters.

Fringe benefits aircraft valuation formula. For purposes of section 1.61-21(g) of the Income Tax Regulations, relating to the rule for valuing non-commercial flights on employer-provided aircraft, the Standard Industry Fare Level (SIFL) cents-per-mile rates and terminal charge in effect for the first half of 2024 are set forth.

26 CFR 1.61-21: Taxation of Fringe Benefit

Provide America’s taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.

The Internal Revenue Bulletin is the authoritative instrument of the Commissioner of Internal Revenue for announcing official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest. It is published weekly.

It is the policy of the Service to publish in the Bulletin all substantive rulings necessary to promote a uniform application of the tax laws, including all rulings that supersede, revoke, modify, or amend any of those previously published in the Bulletin. All published rulings apply retroactively unless otherwise indicated. Procedures relating solely to matters of internal management are not published; however, statements of internal practices and procedures that affect the rights and duties of taxpayers are published.

Revenue rulings represent the conclusions of the Service on the application of the law to the pivotal facts stated in the revenue ruling. In those based on positions taken in rulings to taxpayers or technical advice to Service field offices, identifying details and information of a confidential nature are deleted to prevent unwarranted invasions of privacy and to comply with statutory requirements.

Rulings and procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents. Unpublished rulings will not be relied on, used, or cited as precedents by Service personnel in the disposition of other cases. In applying published rulings and procedures, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered, and Service personnel and others concerned are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same.

The Bulletin is divided into four parts as follows:

Part I.—1986 Code. This part includes rulings and decisions based on provisions of the Internal Revenue Code of 1986.

Part II.—Treaties and Tax Legislation. This part is divided into two subparts as follows: Subpart A, Tax Conventions and Other Related Items, and Subpart B, Legislation and Related Committee Reports.

Part III.—Administrative, Procedural, and Miscellaneous. To the extent practicable, pertinent cross references to these subjects are contained in the other Parts and Subparts. Also included in this part are Bank Secrecy Act Administrative Rulings. Bank Secrecy Act Administrative Rulings are issued by the Department of the Treasury’s Office of the Assistant Secretary (Enforcement).

Part IV.—Items of General Interest. This part includes notices of proposed rulemakings, disbarment and suspension lists, and announcements.

The last Bulletin for each month includes a cumulative index for the matters published during the preceding months. These monthly indexes are cumulated on a semiannual basis, and are published in the last Bulletin of each semiannual period.

For purposes of the taxation of fringe benefits under section 61 of the Internal Revenue Code, section 1.61-21(g) of the Income Tax Regulations provides a rule for valuing noncommercial flights on employer-provided aircraft. Section 1.61-21(g)(5) provides an aircraft valuation formula to determine the value of such flights. The value of a flight is determined under the base aircraft valuation formula (also known as the Standard Industry Fare Level formula or SIFL) by multiplying the SIFL cents-per-mile rates applicable for the period during which the flight was taken by the appropriate aircraft multiple provided in section 1.61-21(g)(7) and then adding the applicable terminal charge. The SIFL cents-per-mile rates in the formula and the terminal charge are calculated by the Department of Transportation (DOT) and are reviewed semi-annually.

The following chart sets forth the terminal charge and SIFL mileage rates:

| Period During Which the Flight Is Taken | Terminal Charge | SIFL Mileage Rates |

|---|---|---|

| 1/1/24 - 6/30/24 | $55.05 |

Up to 500 miles = $.3012 per mile 501-1500 miles = $.2296 per mile Over 1500 miles = $.2208 per mile |

The principal author of this revenue ruling is Kathleen Edmondson of the Office of Associate Chief Counsel (Employee Benefits, Exempt Organizations and Employment Taxes). For further information regarding this revenue ruling, contact Ms. Edmondson at (202) 317-6798 (not a toll-free number).

This notice modifies Notice 2023-29, 2023-29 I.R.B. 1 (July 17, 2023), clarified by Notice 2023-45, 2023-29 I.R.B. 317 (July 17, 2023), by expanding the Nameplate Capacity Attribution Rule under section 4.02(1)(b) of Notice 2023-29 to include additional attribution property and by adding two 2017 North American Industry Classification System (NAICS) industry codes to the table in section 3.03(2) of Notice 2023-29 for purposes of determining the Fossil Fuel Employment rate (as defined in section 3.03(2) of Notice 2023-29). These modifications are set forth in section 3 of this notice.

.01 In General. Public Law 117-169, 136 Stat. 1818 (August 16, 2022), commonly known as the Inflation Reduction Act of 2022 (IRA), amended §§ 45 and 48 of the Internal Revenue Code (Code)1 to provide increased credit amounts or rates if certain requirements pertaining to energy communities are satisfied, and added new §§ 45Y and 48E, which provide increased credit amounts or rates for certain qualified facilities, energy projects, or energy storage technologies that satisfy similar requirements and that are placed in service after December 31, 2024.2

Notice 2023-29 describes certain rules that the Department of the Treasury (Treasury Department) and the Internal Revenue Service (IRS) intend to include in forthcoming proposed regulations for determining what constitutes an energy community, as defined in § 45(b)(11)(B) and as adopted by §§ 45Y(g)(7), 48(a)(14), and 48E(a)(3)(A), and for determining whether a qualified facility, an energy project, or energy storage technology is located in an energy community. Notice 2023-29 also provides that the Treasury Department and the IRS intend to propose that the forthcoming proposed regulations will apply to taxable years ending after April 4, 2023. Taxpayers may rely on the rules described in sections 3 through 6 of Notice 2023-29 until the proposed regulations are published.

Sections 45(b)(11), 48(a)(14), 45Y(g)(7), and 48E(a)(3)(A) provide the requirements that taxpayers must satisfy to qualify EC Projects (defined in section 2 of Notice 2023-29) for increased energy community bonus credit amounts or rates under those provisions of the Code. Section 2 of Notice 2023-29 provides that the term “EC Project” refers to: (1) a qualified facility eligible for a credit determined under § 45 or determined under § 45Y that is located in an energy community; (2) an energy project eligible for a credit determined under § 48, which may include qualified property for which a taxpayer has made a valid irrevocable election under § 48(a)(5) to treat such qualified property as energy property under § 48, that is placed in service within an energy community; or (3) a qualified investment with respect to a qualified facility or energy storage technology eligible for a credit determined under § 48E that is placed in service within an energy community.

Section 45(b)(11)(B) identifies three location-based categories of energy communities for purposes of §§ 45, 45Y, 48, and 48E, described in Notice 2023-29 as the Brownfield Category, the Statistical Area Category, and the Coal Closure Category. The Statistical Area Category includes a metropolitan statistical area (MSA) or non-metropolitan statistical area (non-MSA) that (1) has (or had at any time after December 31, 2009) 0.17 percent or greater direct employment (Fossil Fuel Employment) or 25 percent or greater local tax revenues (Fossil Fuel Tax Revenue) related to the extraction, processing, transport, or storage of coal, oil, or natural gas (as determined by the Secretary of the Treasury or her delegate (Secretary)); and (2) has an unemployment rate at or above the national average unemployment rate for the previous year (as determined by the Secretary).

Section 4 of Notice 2023-29 provides generally applicable rules for determining whether a qualified facility is located in an energy community under §§ 45 or 45Y, and under §§ 48 and 48E, whether an energy project, qualified facility, or energy storage technology, as applicable, is placed in service within an energy community. Section 4.02 of Notice 2023-29 provides that an EC Project is treated as located in or placed in service within an energy community if it satisfies either the Nameplate Capacity Test under section 4.02(1) of that notice or the Footprint Test under section 4.02(2) of that notice.

.02 The Nameplate Capacity Attribution Rule. Under the Nameplate Capacity Test, an EC Project that has nameplate capacity is considered located in or placed in service within an energy community if 50 percent or more of the EC Project’s nameplate capacity is in an area that qualifies as an energy community. The Nameplate Capacity Test includes a Nameplate Capacity Attribution Rule (described in section 4.02(1)(b) of Notice 2023-29). The Nameplate Capacity Attribution Rule provides that if an EC Project with offshore energy generation units has nameplate capacity but none of the EC Project’s energy-generating units are in a census tract, MSA, or non-MSA, then the Nameplate Capacity Test for such EC Project is applied by attributing all the nameplate capacity of such EC Project to the land-based power conditioning equipment that conditions energy generated by the EC Project for transmission, distribution, or use and that is closest to the point of interconnection. Section 3.01 of this notice expands the Nameplate Capacity Attribution Rule to include additional attribution property.

.03 NAICS codes used for determining the Fossil Fuel Employment rate. Section 3.03(2) of Notice 2023-29 provides that for purposes of determining whether an MSA or non-MSA is in the Statistical Area Category based on Fossil Fuel Employment, the relevant direct employment is determined by the number of people employed in the industries identified by the 2017 NAICS industry codes listed in the table in section 3.03(2) of Notice 2023-29. The Fossil Fuel Employment rate is determined as the number of people employed in the industries identified by the 2017 NAICS codes specified in the table and as listed in the annual County Files of the County Business Patterns (CBP) published by the Census Bureau, divided by the total number of people employed in that area. The Fossil Fuel Employment and total employment for each county in an MSA or non-MSA is aggregated for each year to determine whether the MSA or non-MSA meets the Fossil Fuel Employment threshold of 0.17 percent. Section 3.02 of this notice modifies the Fossil Fuel Employment rate determination by adding two NAICS codes to the table provided in section 3.03(2) of Notice 2023-29.

.01 Modification of the Nameplate Capacity Attribution Rule. Section 4.02(1)(b) of Notice 2023-29 is modified to read as follows:

(b) Nameplate Capacity Attribution Rule. If an EC Project with offshore energy generation units has nameplate capacity but none of the EC Project’s energy-generating units are in a census tract, MSA, or non-MSA, then the Nameplate Capacity Test for such EC Project is applied by attributing all the nameplate capacity of such EC Project to: (i) any land-based power conditioning equipment that conditions energy generated by the EC Project for transmission, distribution, or use before the energy is transmitted to the point of interconnection (or in the case of an EC Project with multiple points of interconnection, any land-based power conditioning equipment that conditions energy generated by the EC Project for transmission, distribution, or use before the energy is transmitted to one of the multiple points of interconnection); or (ii) any EC Project supervisory control and data acquisition (SCADA) equipment located in an EC Project Port. EC Project SCADA equipment is property owned by the taxpayer that owns the EC Project and is used to remotely monitor and control the EC Project’s operations. An EC Project Port is defined as a port used either full or part-time to facilitate maritime operations necessary for the installation or operation and maintenance of the EC Project, and with a significant long-term relationship with the EC Project at which staff employed by, or working as independent contractors for, the taxpayer that owns the EC Project are based and perform functions essential to the EC Project’s operations. A port will be considered to have a significant long-term relationship with the EC Project only if the taxpayer that owns the EC Project owns (in whole or in part) or leases (in whole or in part) under a lease agreement with a term of at least 10 years, the port in which the EC Project SCADA equipment is located. Staff employed by, or working as independent contractors for, the taxpayer that owns the EC Project will be considered based in an EC Project Port to perform functions essential to the EC Project’s operations only if the staff perform (collectively, if not individually) all of the following functions: management of marine operations, inventory and handling of spare parts and consumables, and berthing and dispatch of operation and maintenance vessels and associated crews and technicians.

.02 Modification of the Fossil Fuel Employment rate determination by the addition of two NAICS codes.

(1) The table in section 3.03(2) of Notice 2023-29 is modified to read as follows (new codes in bold):

| 2017 NAICS code | Description |

|---|---|

| 211 | Oil and Gas Extraction |

| 2121 | Coal Mining |

| 213111 | Drilling Oil and Gas Wells |

| 213112 | Support Activities for Oil and Gas Operations |

| 213113 | Support Activities for Coal Mining |

| 2212 | Natural Gas Distribution |

| 23712 | Oil and Gas Pipeline and Related Structures Construction |

| 32411 | Petroleum Refineries |

| 4861 | Pipeline Transportation of Crude Oil |

| 4862 | Pipeline Transportation of Natural Gas |

(2) Appendix B to Notice 2023-29 provided the list of MSAs and non-MSAs that meet the Fossil Fuel Employment threshold described in § 45(b)(11)(B)(ii)(I) and section 3.03(2) of Notice 2023-29. Appendix 1 to this notice is a list of additional MSAs and non-MSAs that meet the Fossil Fuel Employment threshold described in Notice 2023-29 after including the two additional NAICS codes. Appendix 1 to this notice, Appendix B to Notice 2023-29, and Appendix 1 to Notice 2023-47 together provide the full list of MSAs and non-MSAs that meet the Fossil Fuel Employment threshold applicable to the period beginning on January 1, 2023.

(3) Appendix 2 to Notice 2023-47 is a list of MSAs and non-MSAs that qualify as energy communities because they meet the Fossil Fuel Employment threshold and have an unemployment rate at or above the national average unemployment rate for calendar year 2022 as described in § 45(b)(11)(B)(ii)(II) and section 3.03(3) of Notice 2023-29. Appendix 2 to this notice is a list of additional MSAs and non-MSAs that qualify as energy communities after including the two additional NAICS codes. Appendix 2 to this notice and Appendix 2 of Notice 2023-47 together provide the full list of energy communities in the Statistical Area Category for the period beginning on January 1, 2023. As provided in section 3.03(3) of Notice 2023-29, the energy community status for the MSAs and non-MSAs listed in Appendix 2 of Notice 2023-47 and Appendix 2 of this notice is effective as of January 1, 2023, and that status will continue until the list is updated based on unemployment rates for calendar year 2023.

Until the proposed regulations are published, taxpayers may rely on the rules described in sections 3 through 6 of Notice 2023-29, as previously clarified by Notice 2023-45 and modified by section 3 this notice, for taxable years ending after April 4, 2023.

Notice 2023-29 is modified as provided in section 3 of this notice. Except as provided in section 3 of this notice, this notice does not otherwise affect the guidance provided in Notice 2023-29.

The principal author of this notice is the Office of Associate Chief Counsel (Passthroughs & Special Industries). However, other personnel from the Treasury Department and the IRS participated in its development. For further information regarding this notice, call the energy security guidance contact number at (202) 317-5254 (not a toll-free number).

Appendix 1: Additional MSAs and non-MSAs that meet the Fossil Fuel Employment threshold that were not included in Appendix B to Notice 2023-29

| State FIPS Code | County FIPS Code | State Name | County or County-Equivalent Entity Name | MSA or non-MSA Code | MSA or non-MSA Name |

|---|---|---|---|---|---|

| 01 | 015 | Alabama | Calhoun County | 11500 | Anniston-Oxford-Jacksonville, AL |

| 01 | 017 | Alabama | Chambers County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 019 | Alabama | Cherokee County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 027 | Alabama | Clay County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 029 | Alabama | Cleburne County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 037 | Alabama | Coosa County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 049 | Alabama | DeKalb County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 071 | Alabama | Jackson County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 095 | Alabama | Marshall County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 111 | Alabama | Randolph County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 121 | Alabama | Talladega County | 100002 | Northeast Alabama nonmetropolitan area |

| 01 | 123 | Alabama | Tallapoosa County | 100002 | Northeast Alabama nonmetropolitan area |

| 04 | 003 | Arizona | Cochise County | 43420 | Sierra Vista-Douglas, AZ |

| 04 | 005 | Arizona | Coconino County | 22380 | Flagstaff, AZ |

| 04 | 019 | Arizona | Pima County | 46060 | Tucson, AZ |

| 04 | 025 | Arizona | Yavapai County | 39140 | Prescott, AZ |

| 05 | 007 | Arkansas | Benton County | 22220 | Fayetteville-Springdale-Rogers, AR-MO |

| 05 | 025 | Arkansas | Cleveland County | 38220 | Pine Bluff, AR |

| 05 | 051 | Arkansas | Garland County | 26300 | Hot Springs, AR |

| 05 | 069 | Arkansas | Jefferson County | 38220 | Pine Bluff, AR |

| 05 | 079 | Arkansas | Lincoln County | 38220 | Pine Bluff, AR |

| 05 | 081 | Arkansas | Little River County | 45500 | Texarkana, TX-AR |

| 05 | 087 | Arkansas | Madison County | 22220 | Fayetteville-Springdale-Rogers, AR-MO |

| 05 | 091 | Arkansas | Miller County | 45500 | Texarkana, TX-AR |

| 05 | 143 | Arkansas | Washington County | 22220 | Fayetteville-Springdale-Rogers, AR-MO |

| 06 | 003 | California | Alpine County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 005 | California | Amador County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 009 | California | Calaveras County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 011 | California | Colusa County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 021 | California | Glenn County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 027 | California | Inyo County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 035 | California | Lassen County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 043 | California | Mariposa County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 049 | California | Modoc County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 051 | California | Mono County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 055 | California | Napa County | 34900 | Napa, CA |

| 06 | 057 | California | Nevada County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 063 | California | Plumas County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 065 | California | Riverside County | 40140 | Riverside-San Bernardino-Ontario, CA |

| 06 | 071 | California | San Bernardino County | 40140 | Riverside-San Bernardino-Ontario, CA |

| 06 | 073 | California | San Diego County | 41740 | San Diego-Carlsbad, CA |

| 06 | 091 | California | Sierra County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 093 | California | Siskiyou County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 103 | California | Tehama County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 105 | California | Trinity County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 107 | California | Tulare County | 47300 | Visalia-Porterville, CA |

| 06 | 109 | California | Tuolumne County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 08 | 013 | Colorado | Boulder County | 14500 | Boulder, CO |

| 09 | 009 | Connecticut | New Haven County | 35300 | New Haven-Milford, CT |

| 09 | 015 | Connecticut | Windham County | 49340 | Worcester, MA-CT |

| 10 | 003 | Delaware | New Castle County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 12 | 001 | Florida | Alachua County | 23540 | Gainesville, FL |

| 12 | 027 | Florida | DeSoto County | 1200003 | South Florida nonmetropolitan area |

| 12 | 033 | Florida | Escambia County | 37860 | Pensacola-Ferry Pass-Brent, FL |

| 12 | 039 | Florida | Gadsden County | 45220 | Tallahassee, FL |

| 12 | 041 | Florida | Gilchrist County | 23540 | Gainesville, FL |

| 12 | 043 | Florida | Glades County | 1200003 | South Florida nonmetropolitan area |

| 12 | 049 | Florida | Hardee County | 1200003 | South Florida nonmetropolitan area |

| 12 | 051 | Florida | Hendry County | 1200003 | South Florida nonmetropolitan area |

| 12 | 065 | Florida | Jefferson County | 45220 | Tallahassee, FL |

| 12 | 073 | Florida | Leon County | 45220 | Tallahassee, FL |

| 12 | 087 | Florida | Monroe County | 1200003 | South Florida nonmetropolitan area |

| 12 | 093 | Florida | Okeechobee County | 1200003 | South Florida nonmetropolitan area |

| 12 | 113 | Florida | Santa Rosa County | 37860 | Pensacola-Ferry Pass-Brent, FL |

| 12 | 129 | Florida | Wakulla County | 45220 | Tallahassee, FL |

| 13 | 013 | Georgia | Barrow County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 015 | Georgia | Bartow County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 035 | Georgia | Butts County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 045 | Georgia | Carroll County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 057 | Georgia | Cherokee County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 059 | Georgia | Clarke County | 12020 | Athens-Clarke County, GA |

| 13 | 063 | Georgia | Clayton County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 067 | Georgia | Cobb County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 077 | Georgia | Coweta County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 085 | Georgia | Dawson County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 089 | Georgia | DeKalb County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 097 | Georgia | Douglas County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 113 | Georgia | Fayette County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 115 | Georgia | Floyd County | 40660 | Rome, GA |

| 13 | 117 | Georgia | Forsyth County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 121 | Georgia | Fulton County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 135 | Georgia | Gwinnett County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 143 | Georgia | Haralson County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 149 | Georgia | Heard County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 151 | Georgia | Henry County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 159 | Georgia | Jasper County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 171 | Georgia | Lamar County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 195 | Georgia | Madison County | 12020 | Athens-Clarke County, GA |

| 13 | 199 | Georgia | Meriwether County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 211 | Georgia | Morgan County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 217 | Georgia | Newton County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 219 | Georgia | Oconee County | 12020 | Athens-Clarke County, GA |

| 13 | 221 | Georgia | Oglethorpe County | 12020 | Athens-Clarke County, GA |

| 13 | 223 | Georgia | Paulding County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 227 | Georgia | Pickens County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 231 | Georgia | Pike County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 247 | Georgia | Rockdale County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 255 | Georgia | Spalding County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 13 | 297 | Georgia | Walton County | 12060 | Atlanta-Sandy Springs-Roswell, GA |

| 16 | 001 | Idaho | Ada County | 14260 | Boise City, ID |

| 16 | 015 | Idaho | Boise County | 14260 | Boise City, ID |

| 16 | 027 | Idaho | Canyon County | 14260 | Boise City, ID |

| 16 | 045 | Idaho | Gem County | 14260 | Boise City, ID |

| 16 | 073 | Idaho | Owyhee County | 14260 | Boise City, ID |

| 17 | 005 | Illinois | Bond County | 41180 | St. Louis, MO-IL |

| 17 | 011 | Illinois | Bureau County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 013 | Illinois | Calhoun County | 41180 | St. Louis, MO-IL |

| 17 | 015 | Illinois | Carroll County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 027 | Illinois | Clinton County | 41180 | St. Louis, MO-IL |

| 17 | 031 | Illinois | Cook County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 037 | Illinois | DeKalb County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 043 | Illinois | DuPage County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 063 | Illinois | Grundy County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 083 | Illinois | Jersey County | 41180 | St. Louis, MO-IL |

| 17 | 085 | Illinois | Jo Daviess County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 089 | Illinois | Kane County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 091 | Illinois | Kankakee County | 28100 | Kankakee, IL |

| 17 | 093 | Illinois | Kendall County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 097 | Illinois | Lake County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 099 | Illinois | LaSalle County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 103 | Illinois | Lee County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 111 | Illinois | McHenry County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 115 | Illinois | Macon County | 19500 | Decatur, IL |

| 17 | 117 | Illinois | Macoupin County | 41180 | St. Louis, MO-IL |

| 17 | 119 | Illinois | Madison County | 41180 | St. Louis, MO-IL |

| 17 | 133 | Illinois | Monroe County | 41180 | St. Louis, MO-IL |

| 17 | 141 | Illinois | Ogle County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 155 | Illinois | Putnam County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 163 | Illinois | St. Clair County | 41180 | St. Louis, MO-IL |

| 17 | 177 | Illinois | Stephenson County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 195 | Illinois | Whiteside County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 197 | Illinois | Will County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 009 | Indiana | Blackford County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 023 | Indiana | Clinton County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 031 | Indiana | Decatur County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 041 | Indiana | Fayette County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 045 | Indiana | Fountain County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 047 | Indiana | Franklin County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 053 | Indiana | Grant County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 065 | Indiana | Henry County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 073 | Indiana | Jasper County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 075 | Indiana | Jay County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 089 | Indiana | Lake County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 107 | Indiana | Montgomery County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 111 | Indiana | Newton County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 121 | Indiana | Parke County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 127 | Indiana | Porter County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 135 | Indiana | Randolph County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 139 | Indiana | Rush County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 159 | Indiana | Tipton County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 171 | Indiana | Warren County | 1800002 | Central Indiana nonmetropolitan area |

| 18 | 177 | Indiana | Wayne County | 1800002 | Central Indiana nonmetropolitan area |

| 19 | 061 | Iowa | Dubuque County | 20220 | Dubuque, IA |

| 20 | 045 | Kansas | Douglas County | 29940 | Lawrence, KS |

| 20 | 091 | Kansas | Johnson County | 28140 | Kansas City, MO-KS |

| 20 | 103 | Kansas | Leavenworth County | 28140 | Kansas City, MO-KS |

| 20 | 107 | Kansas | Linn County | 28140 | Kansas City, MO-KS |

| 20 | 121 | Kansas | Miami County | 28140 | Kansas City, MO-KS |

| 20 | 209 | Kansas | Wyandotte County | 28140 | Kansas City, MO-KS |

| 21 | 093 | Kentucky | Hardin County | 21060 | Elizabethtown-Fort Knox, KY |

| 21 | 123 | Kentucky | Larue County | 21060 | Elizabethtown-Fort Knox, KY |

| 21 | 163 | Kentucky | Meade County | 21060 | Elizabethtown-Fort Knox, KY |

| 23 | 001 | Maine | Androscoggin County | 30340 | Lewiston-Auburn, ME |

| 24 | 015 | Maryland | Cecil County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 25 | 001 | Massachusetts | Barnstable County | 12700 | Barnstable Town, MA |

| 25 | 003 | Massachusetts | Berkshire County | 38340 | Pittsfield, MA |

| 25 | 007 | Massachusetts | Dukes County | 2500006 | Massachusetts nonmetropolitan area |

| 25 | 011 | Massachusetts | Franklin County | 2500006 | Massachusetts nonmetropolitan area |

| 25 | 019 | Massachusetts | Nantucket County | 2500006 | Massachusetts nonmetropolitan area |

| 25 | 027 | Massachusetts | Worcester County | 49340 | Worcester, MA-CT |

| 26 | 087 | Michigan | Lapeer County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 093 | Michigan | Livingston County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 099 | Michigan | Macomb County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 115 | Michigan | Monroe County | 33780 | Monroe, MI |

| 26 | 125 | Michigan | Oakland County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 147 | Michigan | St. Clair County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 161 | Michigan | Washtenaw County | 11460 | Ann Arbor, MI |

| 26 | 163 | Michigan | Wayne County | 19820 | Detroit-Warren-Dearborn, MI |

| 27 | 003 | Minnesota | Anoka County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 005 | Minnesota | Becker County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 007 | Minnesota | Beltrami County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 011 | Minnesota | Big Stone County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 019 | Minnesota | Carver County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 021 | Minnesota | Cass County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 023 | Minnesota | Chippewa County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 025 | Minnesota | Chisago County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 029 | Minnesota | Clearwater County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 033 | Minnesota | Cottonwood County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 035 | Minnesota | Crow Wing County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 037 | Minnesota | Dakota County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 041 | Minnesota | Douglas County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 051 | Minnesota | Grant County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 053 | Minnesota | Hennepin County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 057 | Minnesota | Hubbard County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 059 | Minnesota | Isanti County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 063 | Minnesota | Jackson County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 067 | Minnesota | Kandiyohi County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 069 | Minnesota | Kittson County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 073 | Minnesota | Lac qui Parle County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 077 | Minnesota | Lake of the Woods County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 079 | Minnesota | Le Sueur County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 081 | Minnesota | Lincoln County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 083 | Minnesota | Lyon County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 085 | Minnesota | McLeod County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 087 | Minnesota | Mahnomen County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 089 | Minnesota | Marshall County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 093 | Minnesota | Meeker County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 095 | Minnesota | Mille Lacs County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 097 | Minnesota | Morrison County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 101 | Minnesota | Murray County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 105 | Minnesota | Nobles County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 107 | Minnesota | Norman County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 111 | Minnesota | Otter Tail County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 113 | Minnesota | Pennington County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 117 | Minnesota | Pipestone County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 121 | Minnesota | Pope County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 123 | Minnesota | Ramsey County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 125 | Minnesota | Red Lake County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 127 | Minnesota | Redwood County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 129 | Minnesota | Renville County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 133 | Minnesota | Rock County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 135 | Minnesota | Roseau County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 139 | Minnesota | Scott County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 141 | Minnesota | Sherburne County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 143 | Minnesota | Sibley County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 149 | Minnesota | Stevens County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 151 | Minnesota | Swift County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 27 | 153 | Minnesota | Todd County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 155 | Minnesota | Traverse County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 159 | Minnesota | Wadena County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 163 | Minnesota | Washington County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 167 | Minnesota | Wilkin County | 2700001 | Northwest Minnesota nonmetropolitan area |

| 27 | 171 | Minnesota | Wright County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 27 | 173 | Minnesota | Yellow Medicine County | 2700003 | Southwest Minnesota nonmetropolitan area |

| 29 | 001 | Missouri | Adair County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 005 | Missouri | Atchison County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 007 | Missouri | Audrain County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 009 | Missouri | Barry County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 011 | Missouri | Barton County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 013 | Missouri | Bates County | 28140 | Kansas City, MO-KS |

| 29 | 025 | Missouri | Caldwell County | 28140 | Kansas City, MO-KS |

| 29 | 033 | Missouri | Carroll County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 037 | Missouri | Cass County | 28140 | Kansas City, MO-KS |

| 29 | 039 | Missouri | Cedar County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 041 | Missouri | Chariton County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 045 | Missouri | Clark County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 047 | Missouri | Clay County | 28140 | Kansas City, MO-KS |

| 29 | 049 | Missouri | Clinton County | 28140 | Kansas City, MO-KS |

| 29 | 057 | Missouri | Dade County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 061 | Missouri | Daviess County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 071 | Missouri | Franklin County | 41180 | St. Louis, MO-IL |

| 29 | 075 | Missouri | Gentry County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 079 | Missouri | Grundy County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 081 | Missouri | Harrison County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 087 | Missouri | Holt County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 095 | Missouri | Jackson County | 28140 | Kansas City, MO-KS |

| 29 | 097 | Missouri | Jasper County | 27900 | Joplin, MO |

| 29 | 099 | Missouri | Jefferson County | 41180 | St. Louis, MO-IL |

| 29 | 103 | Missouri | Knox County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 107 | Missouri | Lafayette County | 28140 | Kansas City, MO-KS |

| 29 | 109 | Missouri | Lawrence County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 111 | Missouri | Lewis County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 113 | Missouri | Lincoln County | 41180 | St. Louis, MO-IL |

| 29 | 115 | Missouri | Linn County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 117 | Missouri | Livingston County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 119 | Missouri | McDonald County | 22220 | Fayetteville-Springdale-Rogers, AR-MO |

| 29 | 121 | Missouri | Macon County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 127 | Missouri | Marion County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 129 | Missouri | Mercer County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 137 | Missouri | Monroe County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 139 | Missouri | Montgomery County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 145 | Missouri | Newton County | 27900 | Joplin, MO |

| 29 | 147 | Missouri | Nodaway County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 163 | Missouri | Pike County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 165 | Missouri | Platte County | 28140 | Kansas City, MO-KS |

| 29 | 171 | Missouri | Putnam County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 173 | Missouri | Ralls County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 175 | Missouri | Randolph County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 177 | Missouri | Ray County | 28140 | Kansas City, MO-KS |

| 29 | 183 | Missouri | St. Charles County | 41180 | St. Louis, MO-IL |

| 29 | 189 | Missouri | St. Louis County | 41180 | St. Louis, MO-IL |

| 29 | 197 | Missouri | Schuyler County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 199 | Missouri | Scotland County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 205 | Missouri | Shelby County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 209 | Missouri | Stone County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 211 | Missouri | Sullivan County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 213 | Missouri | Taney County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 217 | Missouri | Vernon County | 2900004 | Southwest Missouri nonmetropolitan area |

| 29 | 219 | Missouri | Warren County | 41180 | St. Louis, MO-IL |

| 29 | 227 | Missouri | Worth County | 2900002 | North Missouri nonmetropolitan area |

| 29 | 510 | Missouri | St. Louis city | 41180 | St. Louis, MO-IL |

| 30 | 001 | Montana | Beaverhead County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 007 | Montana | Broadwater County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 023 | Montana | Deer Lodge County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 031 | Montana | Gallatin County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 039 | Montana | Granite County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 043 | Montana | Jefferson County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 049 | Montana | Lewis and Clark County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 057 | Montana | Madison County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 059 | Montana | Meagher County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 067 | Montana | Park County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 077 | Montana | Powell County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 093 | Montana | Silver Bow County | 3000003 | Southwest Montana nonmetropolitan area |

| 30 | 097 | Montana | Sweet Grass County | 3000003 | Southwest Montana nonmetropolitan area |

| 31 | 079 | Nebraska | Hall County | 24260 | Grand Island, NE |

| 31 | 081 | Nebraska | Hamilton County | 24260 | Grand Island, NE |

| 31 | 093 | Nebraska | Howard County | 24260 | Grand Island, NE |

| 31 | 121 | Nebraska | Merrick County | 24260 | Grand Island, NE |

| 32 | 003 | Nevada | Clark County | 29820 | Las Vegas-Henderson-Paradise, NV |

| 32 | 510 | Nevada | Carson City | 16180 | Carson City, NV |

| 34 | 001 | New Jersey | Atlantic County | 12100 | Atlantic City-Hammonton, NJ |

| 34 | 005 | New Jersey | Burlington County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 34 | 007 | New Jersey | Camden County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 34 | 015 | New Jersey | Gloucester County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 34 | 033 | New Jersey | Salem County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 35 | 001 | New Mexico | Bernalillo County | 10740 | Albuquerque, NM |

| 35 | 043 | New Mexico | Sandoval County | 10740 | Albuquerque, NM |

| 35 | 057 | New Mexico | Torrance County | 10740 | Albuquerque, NM |

| 35 | 061 | New Mexico | Valencia County | 10740 | Albuquerque, NM |

| 36 | 007 | New York | Broome County | 13780 | Binghamton, NY |

| 36 | 029 | New York | Erie County | 15380 | Buffalo-Cheektowaga-Niagara Falls, NY |

| 36 | 063 | New York | Niagara County | 15380 | Buffalo-Cheektowaga-Niagara Falls, NY |

| 36 | 107 | New York | Tioga County | 13780 | Binghamton, NY |

| 37 | 049 | North Carolina | Craven County | 35100 | New Bern, NC |

| 37 | 065 | North Carolina | Edgecombe County | 40580 | Rocky Mount, NC |

| 37 | 081 | North Carolina | Guilford County | 24660 | Greensboro-High Point, NC |

| 37 | 103 | North Carolina | Jones County | 35100 | New Bern, NC |

| 37 | 127 | North Carolina | Nash County | 40580 | Rocky Mount, NC |

| 37 | 137 | North Carolina | Pamlico County | 35100 | New Bern, NC |

| 37 | 151 | North Carolina | Randolph County | 24660 | Greensboro-High Point, NC |

| 37 | 157 | North Carolina | Rockingham County | 24660 | Greensboro-High Point, NC |

| 38 | 003 | North Dakota | Barnes County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 005 | North Dakota | Benson County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 019 | North Dakota | Cavalier County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 021 | North Dakota | Dickey County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 027 | North Dakota | Eddy County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 031 | North Dakota | Foster County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 039 | North Dakota | Griggs County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 045 | North Dakota | LaMoure County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 047 | North Dakota | Logan County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 051 | North Dakota | McIntosh County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 063 | North Dakota | Nelson County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 067 | North Dakota | Pembina County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 071 | North Dakota | Ramsey County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 073 | North Dakota | Ransom County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 077 | North Dakota | Richland County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 079 | North Dakota | Rolette County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 081 | North Dakota | Sargent County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 091 | North Dakota | Steele County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 093 | North Dakota | Stutsman County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 095 | North Dakota | Towner County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 097 | North Dakota | Traill County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 099 | North Dakota | Walsh County | 3800007 | East North Dakota nonmetropolitan area |

| 38 | 103 | North Dakota | Wells County | 3800007 | East North Dakota nonmetropolitan area |

| 39 | 041 | Ohio | Delaware County | 18140 | Columbus, OH |

| 39 | 045 | Ohio | Fairfield County | 18140 | Columbus, OH |

| 39 | 049 | Ohio | Franklin County | 18140 | Columbus, OH |

| 39 | 073 | Ohio | Hocking County | 18140 | Columbus, OH |

| 39 | 089 | Ohio | Licking County | 18140 | Columbus, OH |

| 39 | 097 | Ohio | Madison County | 18140 | Columbus, OH |

| 39 | 117 | Ohio | Morrow County | 18140 | Columbus, OH |

| 39 | 127 | Ohio | Perry County | 18140 | Columbus, OH |

| 39 | 129 | Ohio | Pickaway County | 18140 | Columbus, OH |

| 39 | 133 | Ohio | Portage County | 10420 | Akron, OH |

| 39 | 153 | Ohio | Summit County | 10420 | Akron, OH |

| 39 | 159 | Ohio | Union County | 18140 | Columbus, OH |

| 40 | 031 | Oklahoma | Comanche County | 30020 | Lawton, OK |

| 40 | 033 | Oklahoma | Cotton County | 30020 | Lawton, OK |

| 41 | 005 | Oregon | Clackamas County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 009 | Oregon | Columbia County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 029 | Oregon | Jackson County | 32780 | Medford, OR |

| 41 | 051 | Oregon | Multnomah County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 067 | Oregon | Washington County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 071 | Oregon | Yamhill County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 42 | 011 | Pennsylvania | Berks County | 39740 | Reading, PA |

| 42 | 017 | Pennsylvania | Bucks County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 029 | Pennsylvania | Chester County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 037 | Pennsylvania | Columbia County | 14100 | Bloomsburg-Berwick, PA |

| 42 | 041 | Pennsylvania | Cumberland County | 25420 | Harrisburg-Carlisle, PA |

| 42 | 043 | Pennsylvania | Dauphin County | 25420 | Harrisburg-Carlisle, PA |

| 42 | 045 | Pennsylvania | Delaware County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 049 | Pennsylvania | Erie County | 21500 | Erie, PA |

| 42 | 091 | Pennsylvania | Montgomery County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 093 | Pennsylvania | Montour County | 14100 | Bloomsburg-Berwick, PA |

| 42 | 099 | Pennsylvania | Perry County | 25420 | Harrisburg-Carlisle, PA |

| 42 | 101 | Pennsylvania | Philadelphia County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 133 | Pennsylvania | York County | 49620 | York-Hanover, PA |

| 45 | 017 | South Carolina | Calhoun County | 17900 | Columbia, SC |

| 45 | 039 | South Carolina | Fairfield County | 17900 | Columbia, SC |

| 45 | 055 | South Carolina | Kershaw County | 17900 | Columbia, SC |

| 45 | 063 | South Carolina | Lexington County | 17900 | Columbia, SC |

| 45 | 079 | South Carolina | Richland County | 17900 | Columbia, SC |

| 45 | 081 | South Carolina | Saluda County | 17900 | Columbia, SC |

| 48 | 037 | Texas | Bowie County | 45500 | Texarkana, TX-AR |

| 48 | 145 | Texas | Falls County | 47380 | Waco, TX |

| 48 | 309 | Texas | McLennan County | 47380 | Waco, TX |

| 51 | 007 | Virginia | Amelia County | 40060 | Richmond, VA |

| 51 | 015 | Virginia | Augusta County | 44420 | Staunton-Waynesboro, VA |

| 51 | 033 | Virginia | Caroline County | 40060 | Richmond, VA |

| 51 | 036 | Virginia | Charles City County | 40060 | Richmond, VA |

| 51 | 041 | Virginia | Chesterfield County | 40060 | Richmond, VA |

| 51 | 053 | Virginia | Dinwiddie County | 40060 | Richmond, VA |

| 51 | 075 | Virginia | Goochland County | 40060 | Richmond, VA |

| 51 | 085 | Virginia | Hanover County | 40060 | Richmond, VA |

| 51 | 087 | Virginia | Henrico County | 40060 | Richmond, VA |

| 51 | 101 | Virginia | King William County | 40060 | Richmond, VA |

| 51 | 127 | Virginia | New Kent County | 40060 | Richmond, VA |

| 51 | 145 | Virginia | Powhatan County | 40060 | Richmond, VA |

| 51 | 149 | Virginia | Prince George County | 40060 | Richmond, VA |

| 51 | 183 | Virginia | Sussex County | 40060 | Richmond, VA |

| 51 | 570 | Virginia | Colonial Heights city | 40060 | Richmond, VA |

| 51 | 670 | Virginia | Hopewell city | 40060 | Richmond, VA |

| 51 | 730 | Virginia | Petersburg city | 40060 | Richmond, VA |

| 51 | 760 | Virginia | Richmond city | 40060 | Richmond, VA |

| 51 | 790 | Virginia | Staunton city | 44420 | Staunton-Waynesboro, VA |

| 51 | 820 | Virginia | Waynesboro city | 44420 | Staunton-Waynesboro, VA |

| 53 | 005 | Washington | Benton County | 28420 | Kennewick-Richland, WA |

| 53 | 011 | Washington | Clark County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 53 | 015 | Washington | Cowlitz County | 31020 | Longview, WA |

| 53 | 021 | Washington | Franklin County | 28420 | Kennewick-Richland, WA |

| 53 | 059 | Washington | Skamania County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 55 | 009 | Wisconsin | Brown County | 24580 | Green Bay, WI |

| 55 | 017 | Wisconsin | Chippewa County | 20740 | Eau Claire, WI |

| 55 | 027 | Wisconsin | Dodge County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 035 | Wisconsin | Eau Claire County | 20740 | Eau Claire, WI |

| 55 | 043 | Wisconsin | Grant County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 047 | Wisconsin | Green Lake County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 055 | Wisconsin | Jefferson County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 059 | Wisconsin | Kenosha County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 55 | 061 | Wisconsin | Kewaunee County | 24580 | Green Bay, WI |

| 55 | 065 | Wisconsin | Lafayette County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 077 | Wisconsin | Marquette County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 079 | Wisconsin | Milwaukee County | 33340 | Milwaukee-Waukesha-West Allis, WI |

| 55 | 083 | Wisconsin | Oconto County | 24580 | Green Bay, WI |

| 55 | 089 | Wisconsin | Ozaukee County | 33340 | Milwaukee-Waukesha-West Allis, WI |

| 55 | 093 | Wisconsin | Pierce County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 55 | 103 | Wisconsin | Richland County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 109 | Wisconsin | St. Croix County | 33460 | Minneapolis-St. Paul-Bloomington, MN-WI |

| 55 | 111 | Wisconsin | Sauk County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 127 | Wisconsin | Walworth County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 131 | Wisconsin | Washington County | 33340 | Milwaukee-Waukesha-West Allis, WI |

| 55 | 133 | Wisconsin | Waukesha County | 33340 | Milwaukee-Waukesha-West Allis, WI |

| 55 | 135 | Wisconsin | Waupaca County | 5500003 | South Central Wisconsin nonmetropolitan area |

| 55 | 137 | Wisconsin | Waushara County | 5500003 | South Central Wisconsin nonmetropolitan area |

Appendix 2: Additional MSAs and non-MSAs that qualify as energy communities in 2023 by meeting the Fossil Fuel Employment threshold and the unemployment rate requirement for calendar year 2022 that were not included in Appendix 2 to Notice 2023-47

| State FIPS Code | County FIPS Code | State Name | County or County-Equivalent Entity Name | MSA or non- MSA Code | MSA or non-MSA Name |

|---|---|---|---|---|---|

| 04 | 003 | Arizona | Cochise County | 43420 | Sierra Vista-Douglas, AZ |

| 04 | 005 | Arizona | Coconino County | 22380 | Flagstaff, AZ |

| 04 | 019 | Arizona | Pima County | 46060 | Tucson, AZ |

| 05 | 025 | Arkansas | Cleveland County | 38220 | Pine Bluff, AR |

| 05 | 051 | Arkansas | Garland County | 26300 | Hot Springs, AR |

| 05 | 069 | Arkansas | Jefferson County | 38220 | Pine Bluff, AR |

| 05 | 079 | Arkansas | Lincoln County | 38220 | Pine Bluff, AR |

| 05 | 081 | Arkansas | Little River County | 45500 | Texarkana, TX-AR |

| 05 | 091 | Arkansas | Miller County | 45500 | Texarkana, TX-AR |

| 06 | 003 | California | Alpine County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 005 | California | Amador County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 009 | California | Calaveras County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 011 | California | Colusa County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 021 | California | Glenn County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 027 | California | Inyo County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 035 | California | Lassen County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 043 | California | Mariposa County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 049 | California | Modoc County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 051 | California | Mono County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 06 | 057 | California | Nevada County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 063 | California | Plumas County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 065 | California | Riverside County | 40140 | Riverside-San Bernardino-Ontario, CA |

| 06 | 071 | California | San Bernardino County | 40140 | Riverside-San Bernardino-Ontario, CA |

| 06 | 091 | California | Sierra County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 093 | California | Siskiyou County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 103 | California | Tehama County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 105 | California | Trinity County | 600007 | North Valley-Northern Mountains Region of California nonmetropolitan area |

| 06 | 107 | California | Tulare County | 47300 | Visalia-Porterville, CA |

| 06 | 109 | California | Tuolumne County | 600006 | Eastern Sierra-Mother Lode Region of California nonmetropolitan area |

| 09 | 009 | Connecticut | New Haven County | 35300 | New Haven-Milford, CT |

| 09 | 015 | Connecticut | Windham County | 49340 | Worcester, MA-CT |

| 10 | 003 | Delaware | New Castle County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 17 | 011 | Illinois | Bureau County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 015 | Illinois | Carroll County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 031 | Illinois | Cook County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 037 | Illinois | DeKalb County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 043 | Illinois | DuPage County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 063 | Illinois | Grundy County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 085 | Illinois | Jo Daviess County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 089 | Illinois | Kane County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 091 | Illinois | Kankakee County | 28100 | Kankakee, IL |

| 17 | 093 | Illinois | Kendall County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 097 | Illinois | Lake County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 099 | Illinois | LaSalle County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 103 | Illinois | Lee County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 111 | Illinois | McHenry County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 17 | 115 | Illinois | Macon County | 19500 | Decatur, IL |

| 17 | 141 | Illinois | Ogle County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 155 | Illinois | Putnam County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 177 | Illinois | Stephenson County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 195 | Illinois | Whiteside County | 1700001 | Northwest Illinois nonmetropolitan area |

| 17 | 197 | Illinois | Will County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 073 | Indiana | Jasper County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 089 | Indiana | Lake County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 111 | Indiana | Newton County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 18 | 127 | Indiana | Porter County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

| 21 | 093 | Kentucky | Hardin County | 21060 | Elizabethtown-Fort Knox, KY |

| 21 | 123 | Kentucky | Larue County | 21060 | Elizabethtown-Fort Knox, KY |

| 21 | 163 | Kentucky | Meade County | 21060 | Elizabethtown-Fort Knox, KY |

| 24 | 015 | Maryland | Cecil County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 25 | 001 | Massachusetts | Barnstable County | 12700 | Barnstable Town, MA |

| 25 | 003 | Massachusetts | Berkshire County | 38340 | Pittsfield, MA |

| 25 | 007 | Massachusetts | Dukes County | 2500006 | Massachusetts nonmetropolitan area |

| 25 | 011 | Massachusetts | Franklin County | 2500006 | Massachusetts nonmetropolitan area |

| 25 | 019 | Massachusetts | Nantucket County | 2500006 | Massachusetts nonmetropolitan area |

| 25 | 027 | Massachusetts | Worcester County | 49340 | Worcester, MA-CT |

| 26 | 087 | Michigan | Lapeer County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 093 | Michigan | Livingston County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 099 | Michigan | Macomb County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 115 | Michigan | Monroe County | 33780 | Monroe, MI |

| 26 | 125 | Michigan | Oakland County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 147 | Michigan | St. Clair County | 19820 | Detroit-Warren-Dearborn, MI |

| 26 | 163 | Michigan | Wayne County | 19820 | Detroit-Warren-Dearborn, MI |

| 32 | 003 | Nevada | Clark County | 29820 | Las Vegas-Henderson-Paradise, NV |

| 32 | 510 | Nevada | Carson City | 16180 | Carson City, NV |

| 34 | 001 | New Jersey | Atlantic County | 12100 | Atlantic City-Hammonton, NJ |

| 34 | 005 | New Jersey | Burlington County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 34 | 007 | New Jersey | Camden County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 34 | 015 | New Jersey | Gloucester County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 34 | 033 | New Jersey | Salem County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 35 | 001 | New Mexico | Bernalillo County | 10740 | Albuquerque, NM |

| 35 | 043 | New Mexico | Sandoval County | 10740 | Albuquerque, NM |

| 35 | 057 | New Mexico | Torrance County | 10740 | Albuquerque, NM |

| 35 | 061 | New Mexico | Valencia County | 10740 | Albuquerque, NM |

| 36 | 007 | New York | Broome County | 13780 | Binghamton, NY |

| 36 | 107 | New York | Tioga County | 13780 | Binghamton, NY |

| 37 | 049 | North Carolina | Craven County | 35100 | New Bern, NC |

| 37 | 065 | North Carolina | Edgecombe County | 40580 | Rocky Mount, NC |

| 37 | 081 | North Carolina | Guilford County | 24660 | Greensboro-High Point, NC |

| 37 | 103 | North Carolina | Jones County | 35100 | New Bern, NC |

| 37 | 127 | North Carolina | Nash County | 40580 | Rocky Mount, NC |

| 37 | 137 | North Carolina | Pamlico County | 35100 | New Bern, NC |

| 37 | 151 | North Carolina | Randolph County | 24660 | Greensboro-High Point, NC |

| 37 | 157 | North Carolina | Rockingham County | 24660 | Greensboro-High Point, NC |

| 39 | 133 | Ohio | Portage County | 10420 | Akron, OH |

| 39 | 153 | Ohio | Summit County | 10420 | Akron, OH |

| 41 | 005 | Oregon | Clackamas County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 009 | Oregon | Columbia County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 029 | Oregon | Jackson County | 32780 | Medford, OR |

| 41 | 051 | Oregon | Multnomah County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 067 | Oregon | Washington County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 41 | 071 | Oregon | Yamhill County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 42 | 011 | Pennsylvania | Berks County | 39740 | Reading, PA |

| 42 | 017 | Pennsylvania | Bucks County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 029 | Pennsylvania | Chester County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 037 | Pennsylvania | Columbia County | 14100 | Bloomsburg-Berwick, PA |

| 42 | 041 | Pennsylvania | Cumberland County | 25420 | Harrisburg-Carlisle, PA |

| 42 | 043 | Pennsylvania | Dauphin County | 25420 | Harrisburg-Carlisle, PA |

| 42 | 045 | Pennsylvania | Delaware County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 049 | Pennsylvania | Erie County | 21500 | Erie, PA |

| 42 | 091 | Pennsylvania | Montgomery County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 093 | Pennsylvania | Montour County | 14100 | Bloomsburg-Berwick, PA |

| 42 | 099 | Pennsylvania | Perry County | 25420 | Harrisburg-Carlisle, PA |

| 42 | 101 | Pennsylvania | Philadelphia County | 37980 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

| 42 | 133 | Pennsylvania | York County | 49620 | York-Hanover, PA |

| 48 | 037 | Texas | Bowie County | 45500 | Texarkana, TX-AR |

| 53 | 005 | Washington | Benton County | 28420 | Kennewick-Richland, WA |

| 53 | 011 | Washington | Clark County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 53 | 015 | Washington | Cowlitz County | 31020 | Longview, WA |

| 53 | 021 | Washington | Franklin County | 28420 | Kennewick-Richland, WA |

| 53 | 059 | Washington | Skamania County | 38900 | Portland-Vancouver-Hillsboro, OR-WA |

| 55 | 059 | Wisconsin | Kenosha County | 16980 | Chicago-Naperville-Elgin, IL-IN-WI |

1 Unless otherwise specified, all “section” or “§” references are to sections of the Code.

2 See § 13101(g) of the IRA for the energy community provisions under § 45(b)(11), § 13102(o) of the IRA for the energy community provisions under § 48(a)(14), § 13701(a) of the IRA for the energy community provisions under § 45Y(g)(7), and § 13702(a) of the IRA for the energy community provisions under § 48E(a)(3)(A).

This notice provides guidance regarding qualified student loan bonds under § 144(b) of the Internal Revenue Code (Code)1 to clarify certain requirements for tax-exempt bond financing for loan programs of general application approved by a State under § 144(b)(1)(B) (State Supplemental Loan programs). Specifically, this notice addresses eligibility of borrowers of loans through State Supplemental Loan programs and the loan size limitation for State Supplemental Loans. This notice also provides guidance regarding whether an issue of State or local bonds the proceeds of which are used to finance or refinance qualified student loans (as defined in § 1.150-1(b)) or to finance qualified mortgage loans (as defined in § 1.150-1(b)) is a refunding issue.

Section 144(b)(1) defines a “qualified student loan bond” for which tax-exempt private activity bonds may be issued to mean any bond issued as part of an issue the applicable percentage or more of the net proceeds of which are to be used directly or indirectly to make or finance student loans (that is, loans to pay the costs of postsecondary education) under two types of loan programs.

The first type of loan program, described in § 144(b)(1)(A), is the Federal Family Education Loan Program (FFELP) under the Higher Education Act of 1965, Pub. L. No. 89-329, 79 Stat. 1219 (Higher Education Act), under which education loans are indirectly Federally guaranteed. The FFELP loans that are eligible for tax-exempt bond financing under § 144(b)(1)(A) include, among other types of loans, loans made to parents of undergraduate students under the program known as the “PLUS” loan program. H.R. Conf. Rep. No. 99-841, at II-712 (1986); Sen. Rep. No. 99-313, at 842 (1986). The FFELP guarantee authority extends only to loans originated before July 1, 2010, and was discontinued for loans originated on or after that date. Health Care and Education Reconciliation Act of 2010, Pub. L. No. 111-152, § 2201, 124 Stat. 1029, 1074 (2010).

The second type of loan program, described in § 144(b)(1)(B), is for State Supplemental Loans. Section 144(b)(1)(B) describes a State Supplemental Loan program as a program of general application approved by the State if no loan under such program exceeds the difference between (1) the total cost of attendance and (2) subject to certain stated exceptions, the other forms of student assistance for which the student borrower may be eligible. A program is not treated as described in § 144(b)(1)(B) if such program is described in § 144(b)(1)(A).

.01 Eligible borrower.

Notice 2015-78, 2015-48 I.R.B. 690, provides guidance regarding qualified student loan bonds, including the use of the proceeds of these bonds to make loans that refinance qualified student loans (refinancing loans). Section 3.1 of Notice 2015-78 provides that an eligible borrower of an original loan under a State Supplemental Loan program is a student (with or without a co-obligor or guarantor) or a parent (with or without a co-obligor or guarantor) borrowing on behalf of a child who is a student. Section 3.1 of Notice 2015-78 further provides that an eligible borrower of a refinancing loan under a State Supplemental Loan program is the student or parent borrower of the original loan.

The Department of the Treasury (Treasury Department) and the Internal Revenue Service (IRS) are aware of questions that have arisen as to whether, if the student was the original borrower, the parent of that student is an eligible borrower of a refinancing loan, and similarly, if the parent was the original borrower, whether the student on whose behalf the original loan was made is an eligible borrower of a refinancing loan. Section 4.01 of this notice clarifies that an eligible borrower of a refinancing loan includes either of these parties, regardless of which was the original borrower.