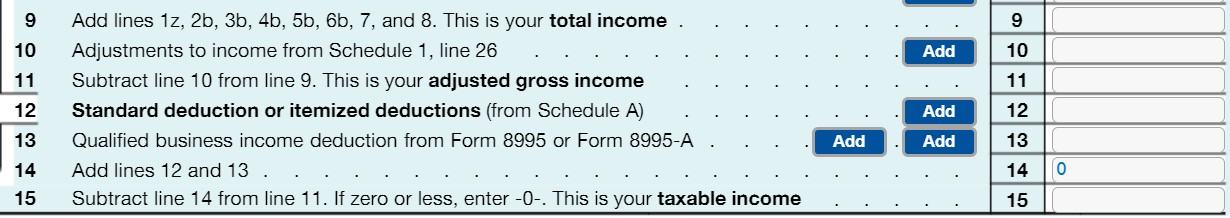

Adjusted gross income, also known as (AGI), is defined as total income minus deductions, or "adjustments" to income that you are eligible to take.

- Gross income includes wages, dividends, capital gains, business and retirement income as well as all other forms income.

- Examples of income include tips, rents, interest, stock dividends, etc.

- Examples of income include tips, rents, interest, stock dividends, etc.

- Adjustments to income are deductions that reduce total income to arrive at AGI.

- Examples of adjustments include half of the self-employment taxes you pay; self-employed health insurance premiums; contributions to certain retirement accounts (such as a traditional IRA); student loan interest paid; educator expenses, etc.

You can find your previous AGI on your 2022 federal tax return to use as a guide. Please refer to Line 11 if you filed a Form 1040.

Your AGI is calculated before you take your standard or itemized deduction on Form 1040.

Important reminder: If you are using the IRS Free File Guided Tax Software and you are filing using the Married Filing Jointly filing status, the $79,000 AGI eligibility amount applies to your combined AGI.

Refer to the 1040 instructions (Schedule 1) PDF for more information on Additional Income and Adjustments to Income.

Example

Adjusted Gross Income (AGI)=gross income–adjustments

Gross Income=Total income. Income from all sources of income.

Adjustments=Expenses the taxpayer paid for with income that the government deems should not be taxed.

Bob's income:

- $50,000 salary/wages

- $12,000 in rental income

- $8,500 wages earned as a part-time Uber driver

- $500 from interest from bonds

Gross income = $71,000

Adjustments from his gross income:

- $250 in educator expenses

- $2,500 in student loan interest

Adjustments = $2,750

Subtracting the Adjustments ($2750) from the Total Income ($71,000), Bob’s AGI is $68,250.