Information on this page is for third-party payers – such as certified professional employer organizations (CPEO), professional employer organizations (PEO) and IRC section 3504 agents – that reported and paid their common law employer clients’ federal employment taxes under the third-party payer’s Employer Identification Number (EIN).

Use this page to see if you’re able to correct or consolidate Employee Retention Credit (ERC) claims for you or your clients by filing a supplemental claim for ERC. You can use this process for claims filed on or before Jan. 31, 2024. As announced on Aug. 8, the IRS made a shift in the moratorium period to Jan. 31, 2024. Therefore, in this program, the agency will not consider claims that weren’t part of previously submitted adjusted employment tax returns filed on or before Jan. 31, 2024. You also can’t include any ERC for a client that wasn’t already claimed in a prior adjusted return filed on or before Jan. 31, 2024.

A supplemental claim is an adjusted employment tax return that allows the third-party payer (TPP) to correct and/or consolidate their previous claims filed on or before Jan. 31, 2024, that have not been processed. This will help the IRS make quicker determinations about whether we can process the claim or if it needs examination.

If you and your clients need help figuring out eligibility for the ERC, use the Employee Retention Credit Eligibility Checklist and check the IRS’s signs that ERC claims are incorrect.

On this page

- Who can file a supplemental claim related to ERC

- How to file a supplemental claim related to ERC

- What happens next

Who can file a supplemental claim related to ERC

The supplemental claim process is for third-party payers (TPP).

This process is not for:

- Common law employers who did not use a TPP and instead filed adjusted employment tax returns using their own employer identification number. These employers may be eligible for either the claim withdrawal process if their claim is pending.

If you are an eligible TPP and you file a supplemental claim, you'll be asking the IRS not to process your outstanding adjusted employment tax returns (Form 941-X, 943-X, Form 944-X and Form CT1-X) for the tax period, including those with other adjustments besides ERC. The IRS will treat claims filed before the supplemental claim as if they were never filed. This allows a TPP who filed a prior claim with multiple clients the ability to “withdraw” only some of the clients while keeping the status of the qualifying clients.

Your supplemental claim needs to include the correct amount of ERC and any other corrections for that tax period.

It is important to note that you can’t include any ERC for a client that wasn’t already claimed in a prior adjusted return filed on or before Jan. 31, 2024.

Work with a trusted tax professional if you need help or advice on this process or on the ERC.

You can file a supplemental claim if all of the following apply:

- You have filed one or more claims aggregating credits for yourself and/or clients using your own EIN.

- You made the claim on an adjusted employment tax return (Forms 941-X, 943-X, 944-X, CT-1X)

- The IRS has not processed any of the claims you’re including in the supplemental claim.

Please note that if you willfully filed a fraudulent ERC claim, or if you assisted or conspired in such conduct, filing a supplemental claim will not exempt you from potential criminal investigation and prosecution.

How to file a supplemental claim related to ERC

Submit supplemental claims by 11:59 p.m. on Dec. 31, 2024.

You can submit a supplemental claim related to ERC only if you haven't received the full amount of ERC claimed on behalf of you and your clients for that tax period.

You will submit your supplemental claim differently if you’ve been notified your claim is under audit. If you have questions about supplemental claims that aren’t answered on this page, see Supplemental claim frequently asked questions for third-party payers.

Preparing your supplemental claim

If you filed adjusted return(s) (Forms 941-X, 943-X, 944-X, CT-1X) to claim the ERC on or before Jan. 31, 2024, and you would like to file a supplemental claim, use the process below.

If you filed adjusted returns for more than one tax period, you must follow the steps below for each tax period for which you are submitting a supplemental claim.

To file a supplemental claim, follow these steps:

- Be sure you have the correct figures to complete your supplemental claim on Form 941-X, 943-X, 944-X or CT-1X.

- Prepare one supplemental claim for each tax period filed on or before Jan. 31, 2024. Each claim must include the correct amount of ERC and any other corrections for that tax period.

Note: Don’t include ERC amounts that were filed after Jan. 31, 2024. The amount of ERC on the supplemental claim must be equal to or less than the cumulative amount of ERC claimed on the returns you’re replacing by filing the supplement claim.

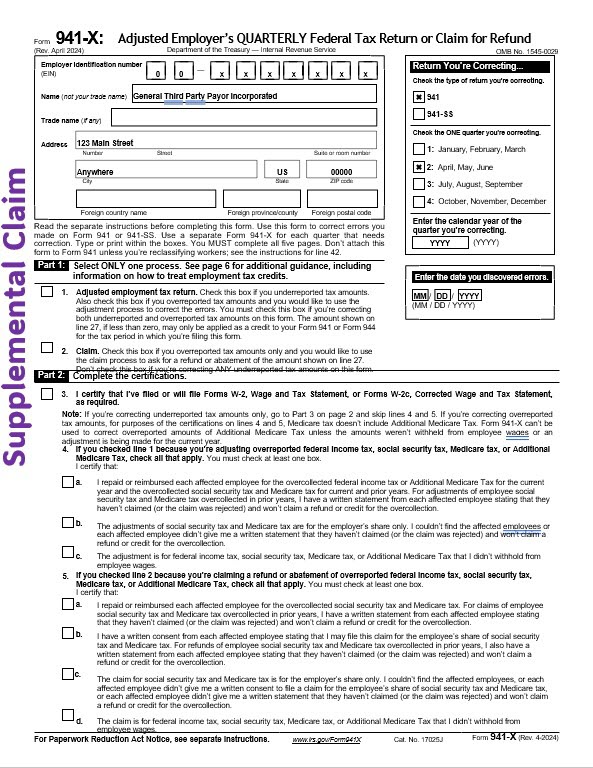

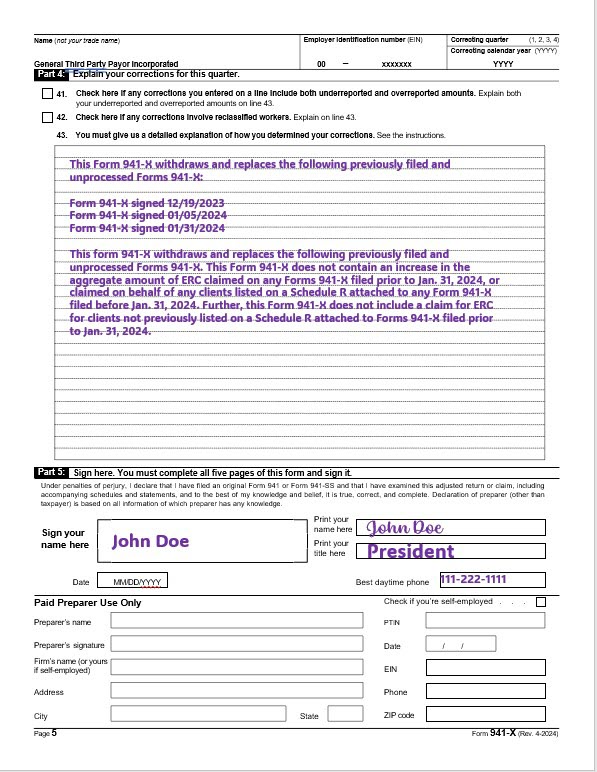

- In Part 4, which is the detailed explanation section of your supplemental claim:

- List the prior adjusted return filing(s) and signature dates on the returns included in the supplemental claim

- Verify and include the following statement: “This form 941-X withdraws and replaces the following previously filed and unprocessed Forms 941-X. This Form 941-X does not contain an increase in the aggregate amount of ERC claimed on any Forms 941-X filed prior to Jan. 31, 2024, or claimed on behalf of any clients listed on a Schedule R attached to any Form 941-X filed before Jan. 31, 2024. Further, this Form 941-X does not include a claim for ERC for clients not previously listed on a Schedule R attached to Forms 941-X filed prior to Jan. 31, 2024.” See the sample supplemental claim for ERC below.

If we receive your supplemental claim after Oct. 17, 2024, without the statement, your supplemental claim will be rejected.

- List the prior adjusted return filing(s) and signature dates on the returns included in the supplemental claim

- In Part 5 of the supplemental claim:

- Have an authorized person sign and date it.

- Write their name and title next to their signature.

- Include your best daytime phone number.

- Prepare a new Form 941, Schedule R, Allocation Schedule for Aggregate Form 941 Filers PDF, using the instructions for Schedule R.

- In the left margin of the first page, write “Supplemental claim.”

Submitting your supplemental claim to the IRS

If you have not been notified that your claim is under audit for the period, fax the signed copy of your supplemental claim using your computer or mobile device to the IRS’s Supplemental Claim for ERC Fax Line at 855-782-2161.

- Submit the supplemental claim for each tax period separately by 11:59 p.m. on Dec. 31, 2024.

- Don’t include other unrelated correspondence.

- This is your submission of your supplemental claim. Keep your copy and your fax confirmation with your tax records.

Note: This fax line is only for third-party payers to submit supplemental claims. The IRS will not process other documents sent to this fax line.

If you have been notified that the IRS is auditing one or more of your adjusted returns, prepare your supplemental claim using the steps above, but don’t submit a supplemental claim for a tax period that’s under audit to the ERC fax line. Instead:

- If you’ve been assigned an examiner, communicate with your examiner about how to submit your supplemental claim directly to them for the tax period under audit.

- If you haven’t been assigned an examiner, respond to your audit notice with your supplemental claim for that tax period by 11:59 p.m. on Dec. 31, 2024, using the instructions in the notice.

- If you’re submitting a supplemental claim for periods that are not under audit, you can use the fax line for those tax periods.

Sample supplemental claim for ERC

Sample Form 941-X, page 1

Sample Form 941-X, page 2

What happens next

The IRS will review your supplemental claim to make sure it has all items necessary to be processed.

If your supplemental claim is complete, the IRS will review the claim and determine if it will be accepted as filed, partially allowed/disallowed, or if your supplemental claim needs additional review or examination.

The supplemental claim becomes the sole adjusted employment tax return for the tax period. The IRS will review your supplemental claims instead of adjusted employment tax returns filed on or before Jan. 31, 2024.

If the IRS rejects your supplemental claim, it will send a letter telling you it’s been rejected. You can resubmit it as a new supplemental claim by Dec. 31, 2024.

Resources

- Supplemental claims for third-party payers: Frequently asked questions

- Employee Retention Credit Eligibility Checklist: Help understanding this complex credit

- Signs ERC claims may be incorrect

- Frequently asked questions about the Employee Retention Credit, including eligibility and the withdrawal process

)

or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

)

or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.